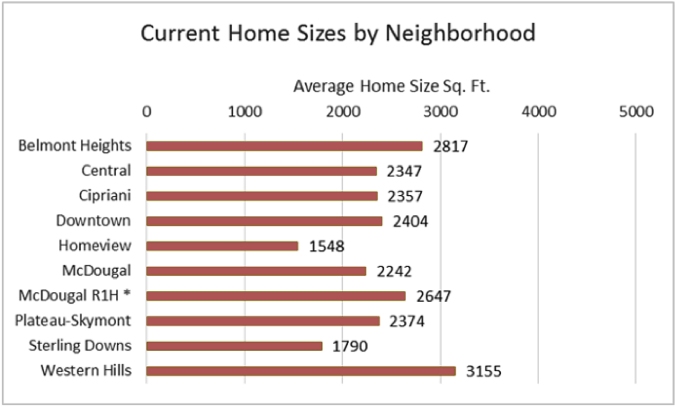

Is raising the floor area cap to 5000 sf needed to remodel current homes? No. The average single family home size in Belmont is 2,300 sf and 95% of homes in Belmont are smaller than the current floor area cap of 3,500 sf (4500 sf for R-1H).

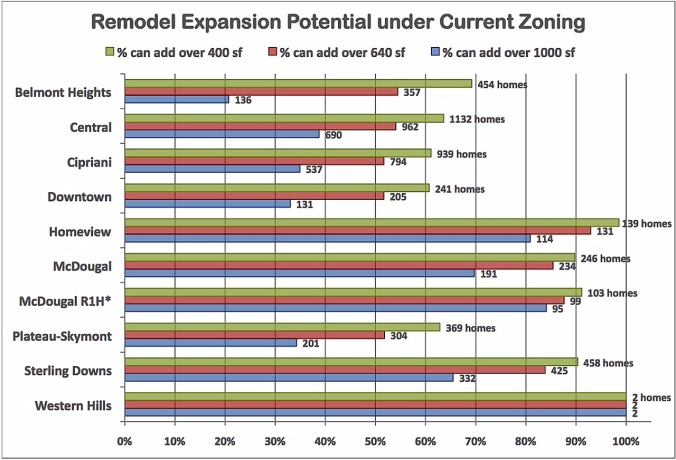

Under existing zoning, 68% of homes can add at least 400 sf, 59% can add at least 640 sf and 41% can add at least 1,000 sf. This represents plenty of opportunities for homeowners to expand to accommodate growing families and remodel under the existing floor area cap. Most residents believe a 3,500 sf home with 5 bedrooms and 3 bathrooms is more than enough room for their families and should be the maximum size in our neighborhoods.

(Note: 400 sf is the size of a 2 car garage, 640 sf is the size of a 1 bedroom apartment, and 1,000 sf is the size of a 2 bedroom house.)

Will the Floor Area Ratio (FAR) table provide the proper home size guidelines if the Floor Area Cap is raised? No. The FAR tables are flawed, way too generous and will not provide the guidelines for proper home sizes.

On the contrary, the FAR table does not prevent homes too big for their lots. For example, a large 40,000 sf lot with a 33% slope permits a resident to build a massive 14,560 sf house! This structure would be squeezed into the 8,000 sf portion of the entire lot representing only the usable, flat part near the front of the street. Steep lots lead to inappropriate sized homes based on the current FAR table and Belmont has many, many steep lots. If a larger size house is appropriate and does not impose on neighbor’s views and privacy, then the existing process of a Floor Area Exception is available. This has worked successfully and should continue to be used for handling these special cases.

Is there difference between allowing 5,000 sf through a Floor Area Exception and raising the Maximum Floor Area Cap to 5,000 sf? Yes! There is a BIG difference between allowing 5000 sf automatically, and requiring the project meet the criteria for a Floor Area Exception.

Currently, if an applicant wants to expand beyond the 3500 sf cap, the “Floor Area Exception” process requires notification of neighbors and public review by Planning Commission. These requirements protect the property rights of neighbors, so views and privacy are not lost [Section 4.2.10 (D)(2)] and property values of neighbors’ homes are not reduced. If the floor area cap is raised to 5,000 sf, as proposed by the Council, homes would be automatically entitled to expand regardless of the impact to neighbors’ rights, and property values. The neighbors would have NO opportunity to voice concerns for their own property rights. Hence, keeping the 3500 sf cap and allowing expansion through “Floor Area Exception” under the current zoning ordinances provides protections for neighbors while still allowing exceptions where they are appropriate.

Will a bigger house next door raise my property value? No. On the contrary, your property value could go down. Supersized homes sell for less money per square foot, and can also destroy the natural serenity, harmony and charm of the neighborhood.

An over-sized house that looms over neighbors, looks down over fences into other homes’ windows and yards, obstructs views, crowds natural surroundings, reduces the feeling of open space, and does not add to the appeal of a neighborhood. They can make a neighborhood less desirable and hurt property values. Why would any buyer pay a premium for a “view” knowing that two adjacent neighbors can build monster homes that will block their views and invade their privacy in the future? After ignoring supersizing for years in the Los Angeles areas, 20 neighborhoods recently banned them after suffering drops in their property values.

Does bigger houses mean more people and cars? Yes, bigger houses definitely means more people, such as rooms rented out, adult children living at home, parents moving in, and live-in nanny/caretakers. All of these situations lead to more residents and thus more traffic congestion, more students in our classrooms, more cars parked on the streets, and more strain on city services. A City staff report confirmed that the number of bedrooms is the best indicator of parking demand. Thus more bedrooms correlates with more cars, and larger homes can accommodate more bedrooms. This means more people and more cars!

Does Belmont have the most restrictive zoning requirements? No, the floor area cap is not the restrictive part of zoning. Most homeowner complaints regarding zoning rules came from the Garage Addition requirement for small remodels. This requirement has now been eliminated. There is no indication that floor area caps have prevented a single “modest remodel”.

Does Belmont have an obligation to allow bigger homes? No. Bigger homes are less affordable, and do nothing to help the housing affordability crisis. Nor does Belmont owe the region more housing; Belmont already has a higher housing to employment ratio than any of the surrounding cities. We are doing more than our fair share, and the city suffers economically for it with tax revenues overly dependent on property tax, to the neglect of commercial revenues.

Will the new design review process prevent “McMansions” in Belmont? No. The design review process aims to reduce the appearance of bulkiness, with setbacks and by breaking up large walls, but it does not limit the size and scale of the house, nor does it consider neighborhood “fit”. Raising the floor area cap to 5000 sf, along with legal Floor Area Exceptions, encourages “McMansions” to be built in Belmont.

Will the tax revenue from larger homes cover the added burden to infrastructure? No. In fact, the added infrastructure burden of big homes outweighs the small tax gain. On a $100,000 remodel, the property tax goes up $1,000 annually, of which the city receives only $100. Thus only .01% of assessed value goes to the city, and that is not enough to cover the added burden to city services, roads, storm drains, etc. Other cities depend on business taxes to broaden their tax revenue base.

You must be logged in to post a comment.